Navigating the complexities of tax laws can be a daunting task for individuals and businesses alike. With constantly changing regulations and the potential for costly mistakes, it’s essential to have the right tools at your disposal. Enter ZeroTax Al—an innovative platform that harnesses the power of artificial intelligence to streamline tax processes, maximize savings, and ensure compliance. In this blog post, we’ll explore how ZeroTax.ai can transform your tax strategy and help you keep more of your hard-earned money.

Understanding the Need for Intelligent Tax Solutions

The Challenges of Traditional Tax Preparation

Traditional tax preparation methods often involve a maze of paperwork, outdated software, and time-consuming calculations. According to the IRS, millions of taxpayers face audits each year, many stemming from common errors or misinterpretations of tax laws. Additionally, small businesses often lack the resources for in-house tax experts, making them vulnerable to costly mistakes.

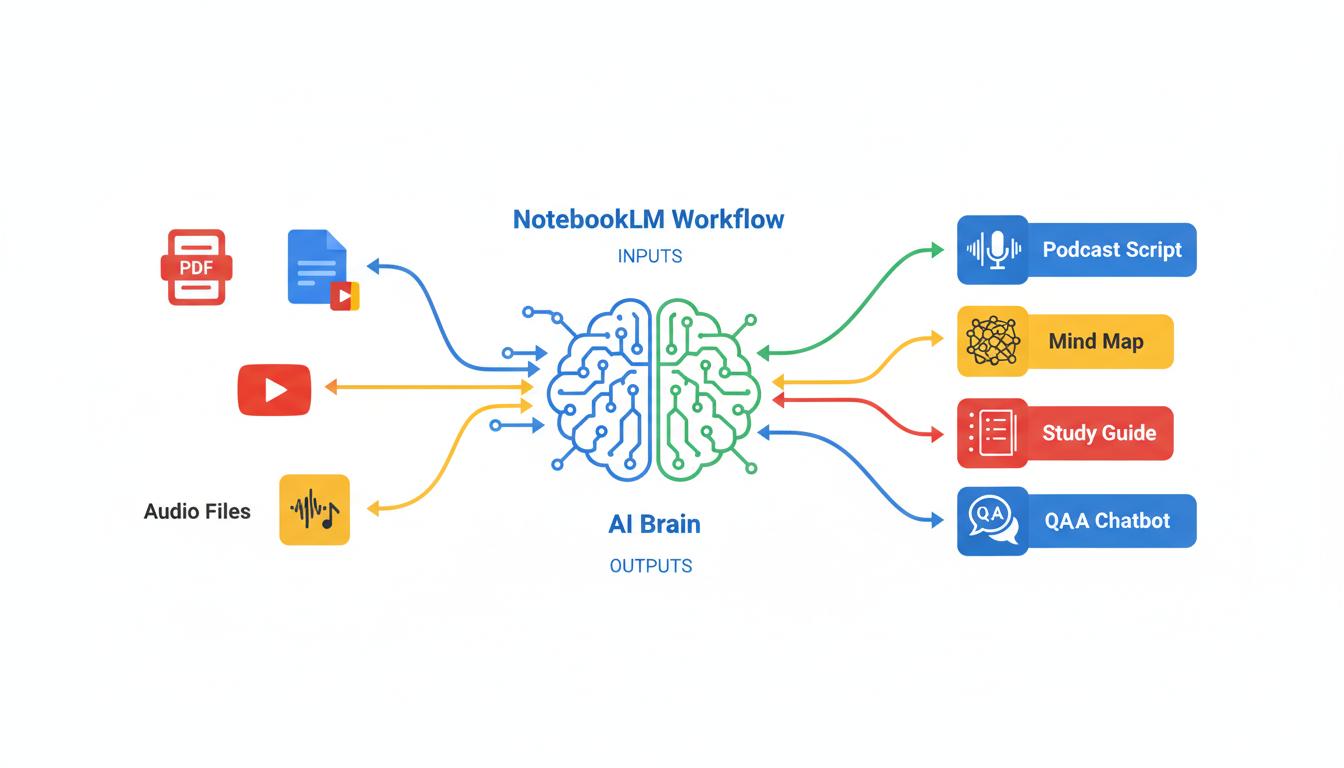

The Rise of AI in Taxation

Artificial intelligence is revolutionizing various industries, and tax preparation is no exception. AI-powered solutions can analyze vast amounts of data quickly, identify deductions, and reduce the risk of errors. ZeroTax.ai stands out in this space, offering an intelligent solution designed to simplify the tax process and maximize your savings.

What is ZeroTax Al?

ZeroTax.ai is an advanced AI-driven tax software platform designed to help users manage their tax obligations efficiently. By leveraging cutting-edge algorithms, the platform offers features that cater to both individuals and businesses, ensuring compliance while maximizing deductions.

Key Features of ZeroTax.ai

- Automated Data Entry: ZeroTax.ai streamlines the tax preparation process by automatically importing financial data from various sources, minimizing the need for manual entry and reducing errors.

- Intelligent Deduction Maximization: The platform analyzes your financial situation to identify potential deductions and credits you may qualify for, ensuring you don’t leave money on the table.

- Real-Time Compliance Monitoring: ZeroTax.ai keeps you updated on changing tax laws and regulations, ensuring that your filings are compliant and up to date.

- User-Friendly Interface: The platform is designed with user experience in mind, making it easy for anyone to navigate through their tax preparation journey.

- Secure Data Management: With robust encryption and security protocols, ZeroTax Al ensures that your sensitive financial information is protected.

Benefits of Using ZeroTax.ai

1. Simplified Tax Preparation

ZeroTax.ai eliminates the stress often associated with tax season. Its automated data entry and user-friendly interface allow users to complete their taxes quickly and efficiently, freeing up time for more important tasks.

2. Maximized Tax Savings

By intelligently identifying deductions and credits, ZeroTax Al ensures that you take full advantage of the tax benefits available to you. This could result in significant savings, whether you’re an individual taxpayer or a business owner.

3. Reduced Risk of Errors

Human error is a common issue in tax preparation. ZeroTax Al minimizes this risk through automation and intelligent analysis, allowing for more accurate filings and reducing the likelihood of audits.

4. Enhanced Compliance

Tax laws are constantly evolving, and staying compliant can be challenging. ZeroTax Al provides real-time updates on relevant changes in tax regulations, helping you navigate complex rules and avoid penalties.

5. Cost-Effective Solution

Hiring a tax professional can be expensive, particularly for small businesses. ZeroTax Al offers an affordable alternative, providing powerful tax tools without the hefty price tag associated with traditional tax services.

How to Get Started with ZeroTax.ai

Step 1: Sign Up

Getting started with ZeroTax Al is simple. Visit ZeroTax Al and create an account. The sign-up process is quick and user-friendly, requiring minimal information.

Step 2: Connect Your Financial Accounts

Once registered, you can securely connect your bank accounts, investment platforms, and other financial sources. ZeroTax Al will automatically import your data, saving you hours of manual entry.

Step 3: Explore the Dashboard

After your data is imported, take some time to explore the user-friendly dashboard. Here, you’ll find all the tools you need to navigate your tax preparation, including deduction suggestions and compliance alerts.

Step 4: Review and File Your Taxes

As you progress through the tax preparation process, ZeroTax Al will guide you in reviewing your information, suggesting deductions, and ensuring compliance. Once everything is in order, you can file your taxes directly through the platform.

Step 5: Stay Informed

After filing, ZeroTax Al continues to monitor tax laws and regulations relevant to your situation. You’ll receive updates and insights that can help you plan for future tax years.

Best Practices for Maximizing Your Experience with ZeroTax.ai

1. Keep Your Financial Records Organized

Having organized financial records will make the data entry process smoother. Regularly update your accounts and ensure all documents are readily available for a seamless tax preparation experience.

2. Take Advantage of Educational Resources

ZeroTax.ai offers various resources and guides to help users understand tax laws and strategies. Take the time to explore these materials, as they can provide valuable insights that may lead to additional savings.

3. Monitor Changes in Tax Laws

Stay proactive about changes in tax legislation that may impact your finances. ZeroTax Al provides real-time updates, but it’s always beneficial to stay informed through other reliable sources as well.

4. Engage with Customer Support

If you encounter any issues or have questions, don’t hesitate to reach out to ZeroTax.ai’s customer support. They can provide assistance and ensure you make the most of the platform’s features.

5. Plan Ahead for Next Year

Tax planning shouldn’t be a last-minute task. Use the insights gained from this year’s filing to inform your financial decisions for the upcoming year, allowing you to maximize your deductions and minimize your tax liability.

Conclusion

In a world where tax laws are ever-evolving and complexities abound, having the right tools is essential. ZeroTax.ai offers a powerful, user-friendly platform that simplifies tax preparation while maximizing savings. By leveraging AI technology, it provides a cost-effective solution that can benefit both individuals and businesses alike.

Don’t let tax season stress you out—embrace the future of tax preparation with ZeroTax Al. Visit ZeroTax.ai today to learn more about how you can streamline your tax process, enhance compliance, and keep more of your money in your pocket.

Call to Action

Are you ready to simplify your tax preparation and maximize your savings? Sign up for a free trial of ZeroTax Al today and discover the benefits of intelligent tax solutions. Take control of your finances and ensure that you never leave money on the table again!