In today’s fast-paced business world, accurate financial valuation and insightful data analysis are crucial for strategic decision-making and investment success. Revalio, a cutting-edge platform in the financial technology space, offers a powerful solution for automating asset valuation and gaining deep financial insights. Whether you’re an investor, financial analyst, or business owner, Revalio provides the tools you need to make informed decisions and drive growth. In this blog post, we’ll explore how is transforming the landscape of financial valuation and analysis, and how it can benefit your organization or investment strategy.

What is Revalio?

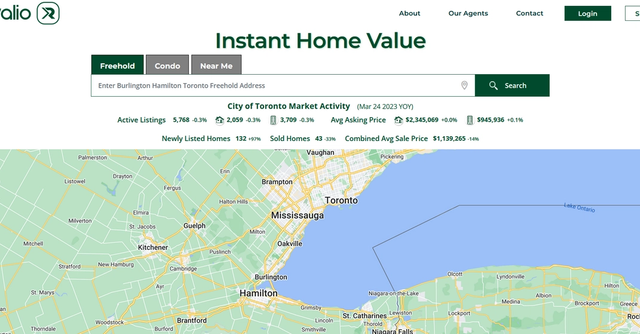

Revalio is an advanced platform designed to streamline the process of asset valuation and financial analysis through automation and artificial intelligence (AI). It provides a suite of tools and features that enable users to perform accurate valuations, generate detailed financial reports, and gain actionable insights into their assets and investments. By leveraging sophisticated algorithms and machine learning, simplifies complex financial tasks and enhances decision-making capabilities.

Key Features of Revalio

1. Automated Valuation:

One of the core features of Revalio is its automated valuation capability. Traditional asset valuation methods can be time-consuming and prone to errors. Revalio’s platform uses AI algorithms to perform valuations quickly and accurately, taking into account a wide range of factors such as market trends, financial performance, and economic conditions. This automation reduces the risk of human error and provides users with reliable valuation results.

2. Comprehensive Financial Analysis:

Revalio offers in-depth financial analysis tools that allow users to assess the performance and potential of their investments. The platform’s advanced analytics capabilities enable users to analyze financial statements, evaluate key performance indicators (KPIs), and identify trends and patterns. This comprehensive analysis helps users make informed decisions and develop effective strategies for growth.

3. Real-Time Data Integration:

In the dynamic world of finance, having access to real-time data is essential. integrates with various data sources to provide users with up-to-date information on market conditions, asset performance, and economic indicators. This real-time data integration ensures that users have the latest insights at their fingertips, allowing them to respond to market changes and make timely decisions.

4. Customizable Reports:

Revalio’s platform allows users to generate customizable financial reports that meet their specific needs. Users can create detailed reports that include valuation results, financial performance metrics, and other relevant data. These customizable reports can be tailored to different stakeholders, such as investors, board members, or regulatory bodies, ensuring that the right information is presented in the most effective manner.

5. Risk Assessment and Management:

Effective risk management is crucial for financial success. Revalio’s risk assessment tools help users identify and evaluate potential risks associated with their investments and assets. By analyzing historical data, market trends, and other risk factors, provides users with insights into potential vulnerabilities and helps them develop strategies to mitigate risks.

6. User-Friendly Interface:

Revalio is designed with user experience in mind. The platform features an intuitive and user-friendly interface that simplifies complex financial tasks. Whether you’re a seasoned financial professional or a novice investor, Revalio’s interface makes it easy to navigate the platform, access tools, and perform valuations and analyses efficiently.

Benefits of Using Revalio

1. Enhanced Accuracy:

Accurate valuations are crucial for making informed investment decisions and managing financial assets. Revalio’s automated valuation algorithms and advanced analytics ensure that valuations are precise and reliable. By reducing the risk of human error and incorporating comprehensive data, enhances the accuracy of financial assessments.

2. Time and Cost Savings:

Manual valuation and analysis can be time-consuming and resource-intensive. Revalio’s automation streamlines these processes, allowing users to perform valuations and analyses more quickly and efficiently. This time and cost savings enable users to focus on strategic decision-making and other high-value activities.

3. Improved Decision-Making:

Revalio’s comprehensive financial analysis tools provide users with valuable insights into their investments and assets. By analyzing financial performance, market trends, and risk factors, users can make well-informed decisions that drive growth and optimize financial outcomes.real-time data integration ensures that users have access to the most current information for timely decision-making.

4. Customization and Flexibility:

Different stakeholders have different needs when it comes to financial reporting and analysis. Revalio’s customizable reporting features allow users to tailor reports to specific audiences, ensuring that relevant information is presented effectively. This flexibility enhances communication and helps users address the needs of various stakeholders.

5. Risk Mitigation:

Identifying and managing risks is essential for financial success. Revalio’s risk assessment tools provide users with insights into potential vulnerabilities and help them develop strategies to mitigate risks. By proactively addressing risk factors, users can protect their investments and assets from potential adverse impacts.

6. Scalability:

As your financial needs and investment portfolio grow, scales with you. The platform’s robust features and capabilities can handle increasing volumes of data and complex financial tasks, ensuring that you continue to benefit from its automation and analysis tools as your requirements evolve.

How to Get Started with Revalio

1. Define Your Objectives:

Before using Revalio, it’s important to define your specific objectives and needs. Whether you’re looking to automate asset valuations, analyze financial performance, or generate customized reports, having clear goals will help you leverage features effectively.

2. Explore the Platform:

Familiarize yourself with Revalio’s tools and features by exploring the platform. offers resources and support to help users understand how to use the platform’s capabilities. Take the time to review the available features and determine which ones align with your objectives.

3. Integrate Your Data:

Revalio integrates with various data sources to provide real-time information and insights. Ensure that your data sources are properly integrated with the platform to maximize the benefits of Revalio’s analytics and reporting tools.

4. Customize Your Reports:

Utilize Revalio’s customizable reporting features to create reports that meet your specific needs. Tailor reports to different stakeholders and ensure that the information presented is relevant and actionable.

5. Monitor and Optimize:

Once you’ve implemented , continuously monitor its performance and impact on your financial operations. Use the insights gained from the platform to make ongoing adjustments and optimizations. Regularly review your objectives and assess how is contributing to your financial success.

Conclusion

Revalio is a powerful solution for automating asset valuation and gaining deep financial insights. With its advanced AI-driven features, including automated valuation, comprehensive financial analysis, real-time data integration, and customizable reporting, empowers users to make informed decisions and drive financial success. By enhancing accuracy, saving time and costs, and improving decision-making, offers significant benefits for investors, financial analysts, and business owners.

Whether you’re managing investments, analyzing financial performance, or developing strategies for growth, provides the tools and insights you need to achieve your financial goals. Embrace the future of financial technology and unlock the potential for success in your financial endeavors.